Trump Media Launches Truth.Fi with $250 Million Crypto Investments 💰

By Jed Barker

Written by Jed Barker, Chief Editor Fact-Checked

Issue #465 Updated: January 30, 2025

Share

Good Morning! 🌞 All eyes were on the FOMC meeting, where the Federal Reserve kept rates unchanged at 4.25-4.5%, retracting its progress statement towards achieving 2% inflation. Crypto prices remained stable in the first 20 minutes.

Meanwhile, Trump Media launched the Truth.Fi cryptocurrency with a $250 million investment, and the Czech central bank is considering a historic $7 billion investment in Bitcoin.

Here's what you need to know. 👇

Trump Media Launches Truth.Fi with $250 Million Crypto Investment 💸

Trump Media & Technology Group (TMTG) is expanding into financial services by launching Truth.Fi, a fintech and investment platform, reports WSJ. The company's board approved a $250 million investment in Truth.Fi, which will include ETFs, Bitcoin, and other cryptocurrencies.

Charles Schwab will oversee custody and investment strategy, while Yorkville Advisors will act as a registered investment advisor for specific financial products. TMTG CEO Devin Nunes called this move a "natural extension," according to Fortune.

TMTG shares jumped 10% on Wednesday after the announcement, reflecting strong investor interest. The company stated that Truth.Fi will focus on investments in manufacturing and energy companies, aligning with its broader goal of supporting what it calls the "Patriotic Economy."

The expansion comes amid Trump's criticism of big banks for allegedly limiting services to conservatives. Truth.Fi is expected to launch in 2025, marking another step in TMTG's broader efforts to create an independent financial and technology platform. 🚀

Czech Central Bank Considers $7 Billion Bitcoin Investment 💱

The head of the Czech National Bank (CNB), Aleš Michl, plans to propose investing up to $7 billion of the country's reserves in Bitcoin. If approved, the CNB would become the first Western central bank to hold BTC as part of its foreign exchange reserves. In December, the country's parliament unanimously exempted Bitcoin held for three years from capital gains tax.

Michl cited growing institutional investor activity and President Trump's stance on cryptocurrencies as key factors behind the proposal. "For diversifying our assets, Bitcoin seems like a good option," Michl said in an interview with the Financial Times. The central bank's board will review the proposal on Thursday, and if accepted, Bitcoin could be added to reserves alongside traditional assets. 🏦

Cardano Completes Plomin Hard Fork 🔗

Cardano is set to implement fully decentralized governance with the activation of the Plomin hard fork, granting ADA holders direct voting rights on protocol updates and treasury decisions. The network upgrade followed a successful vote, with 85% of stake pools and 67% of Interim Constitutional Committee (ICC) members approving the transition.

The hard fork implements governance changes outlined in CIP-1694, including treasury withdrawals and decentralized representative voting (DRep). "Today, Cardano evolves," stated representatives from the Cardano Foundation on X, confirming the network's shift to decentralized decision-making. ADA prices dropped over 5% in the past day, reflecting broader market sentiment. 📉

Cboe BZX Re-Submits Solana ETF Applications in the U.S. 📈

The Cboe BZX Exchange has re-submitted applications for Solana exchange-traded funds (ETFs) on behalf of Bitwise, VanEck, 21Shares, and Canary Capital. These applications were previously rejected by the SEC but were re-submitted following a change in leadership under the new SEC chair, Marc Uyeda, who is crypto-friendly.

If approved, Solana would become the third cryptocurrency to have an ETF in the U.S., following Bitcoin and Ethereum. Bloomberg ETF analyst Eric Balchunas called JPMorgan's forecast that the Solana ETF could attract up to $6 billion in its first year a "reasonable assumption." The updates come as fund issuers test the boundaries of SEC approval under the Trump administration. 🏛️

Data of the Day

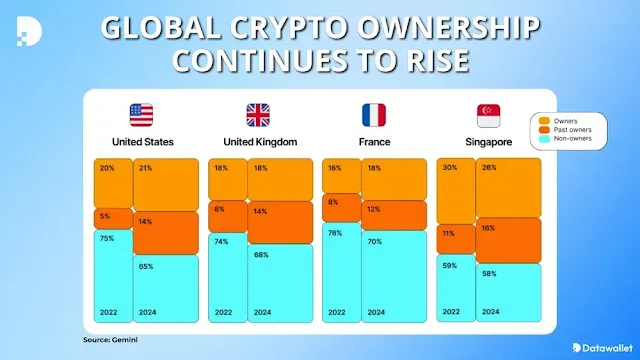

Gemini's "State of Crypto 2024" report shows that in countries like the U.S., UK, France, and Singapore, crypto holders consistently hold digital assets with 65% expecting long-term growth. Regulatory uncertainty remains a significant barrier to crypto adoption, with nearly 40% of non-holders in the U.S. and UK citing it as a concern.

Despite market downturns, over 70% of past crypto holders are likely to return to the market in the near future. The report also notes the rise of Bitcoin ETF funds, indicating growing interest from institutional and retail investors. Most crypto holders are ready to include digital assets in their investment portfolios, with 57% willing to allocate 5% or more. 📊

Post a Comment